Compound interest calculator with annual withdrawals

The Federal Reserve has been aggressively raising its benchmark interest rate in an effort to curb inflation which is at a 40-year high of 91 percent on an annual basis. The annual rate of return for this investment or savings account.

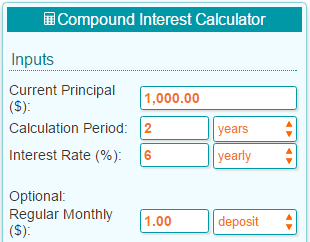

Compounding Interest Calculator Yearly Monthly Daily

Most years have 365 days while leap years have 366 days.

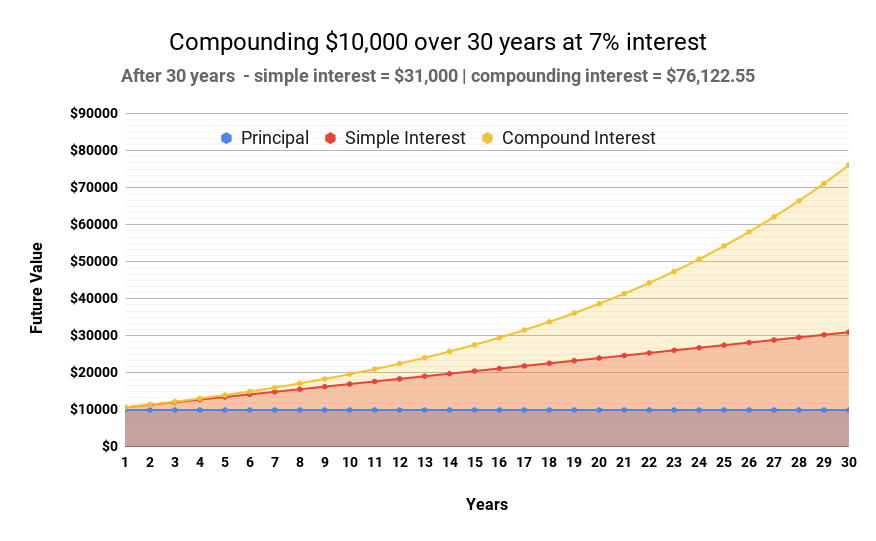

. A the future value or FV of the investmentloan including interest. Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested earning you more interest. Free calculator to find out the balance and interest of a savings account while accounting for tax inflation periodic contributions compounding frequency.

Using this compound interest calculator Try your calculations both with and without a monthly contribution say 50 to 200 depending on what you can afford. The above calculator automatically does this for you but if you wanted to calculate compound interest manually the formula is. How to avoid early.

Hello Sir i was trying to calculate compound interest for years that are in decimal. Our simple savings calculator helps you project the growth and future value of your money over time. The lower the age the lower the minimum amount and the less income tax youll pay on the withdrawals.

Even small deposits to a. Compound Interest Calculator Savings Account Interest Calculator Consistent investing over a long period of time can be an effective strategy to accumulate wealth. Annual Interest 400 400 400 400 400.

FV future value. Best and worst states for retirement. The majority of Australian savings accounts that provide compound interest allow you to make withdrawals and additional deposits whenever you need to.

But will vary in traits such as synergy with checking accounts of the same institution annual percentage yield APY and minimum balance requirements. To earn 150 APY you have to meet the following requirements. Using an online compound interest calculator we can calculate how much the same amount would grow to using compound interest.

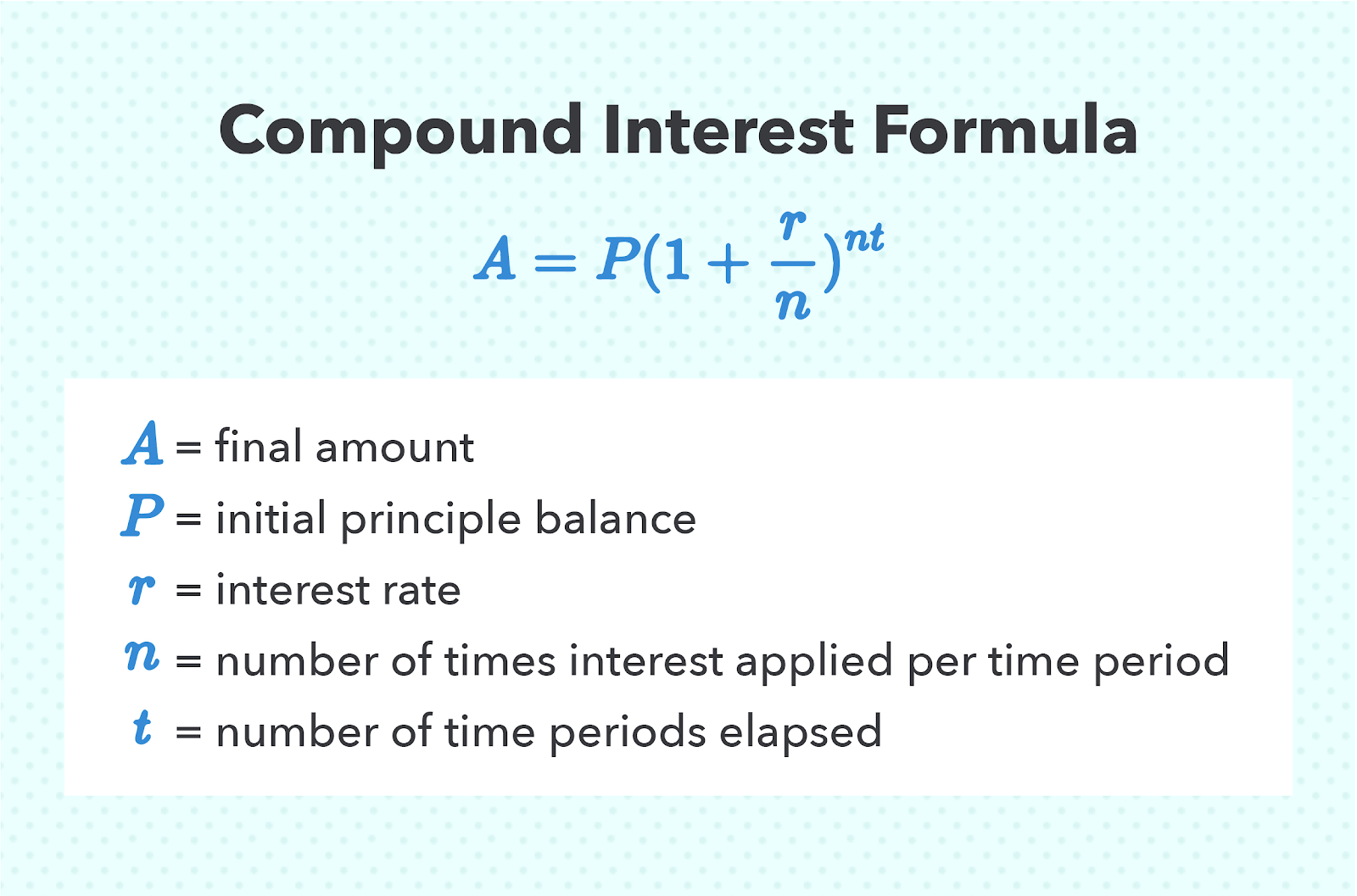

N the number compounding periods per year n 1 for annually n 12 for monthly etc. Suitable for savings or loan interest calculations. R is also known as rate of return.

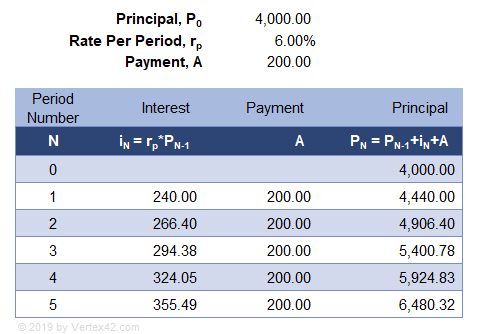

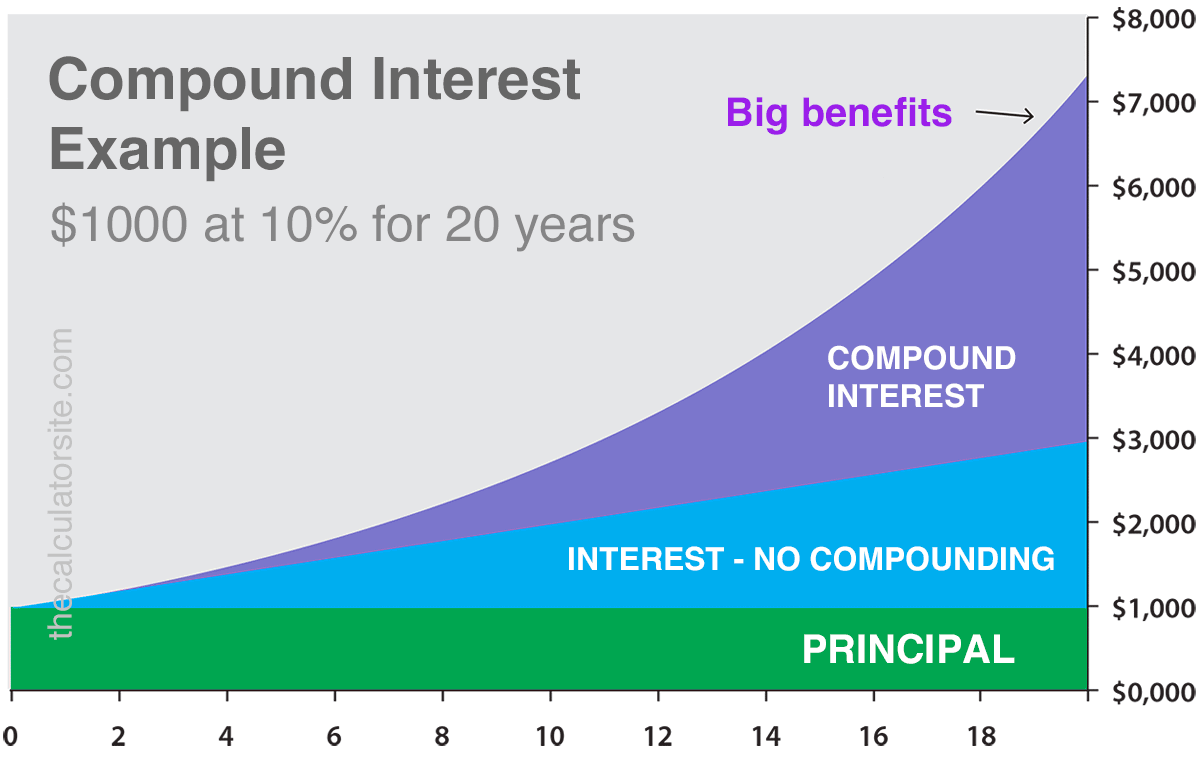

Compound interest or compounding interest is interest calculated on the initial principal which also includes all the accumulated interest of previous periods of a deposit. Compound interest or interest on interest is calculated using the compound interest formula. Regarding the first financial.

The Standard Poors 500 SP 500 for the 10 years ending December 31 st 2021 had an annual compounded rate of return of 136 including reinvestment of dividends. R the annual interest rate expressed in decimal form decimal 100. If your spouse is younger than you you can use their age to calculate your minimum amount.

Best age to take Social Security. Thought to have. FV PV 1 rn nt.

You can include regular withdrawals within your compound interest calculation as either a monetary withdrawal or as a percentage of interestearnings. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. Compound annual growth rate calculator.

This means there is a bit more than 52 weeks in the average year with there being 52 weeks and 1 day in most years while there is 52 weeks and 2. This savings calculator includes. Calculates interest amount and ending value.

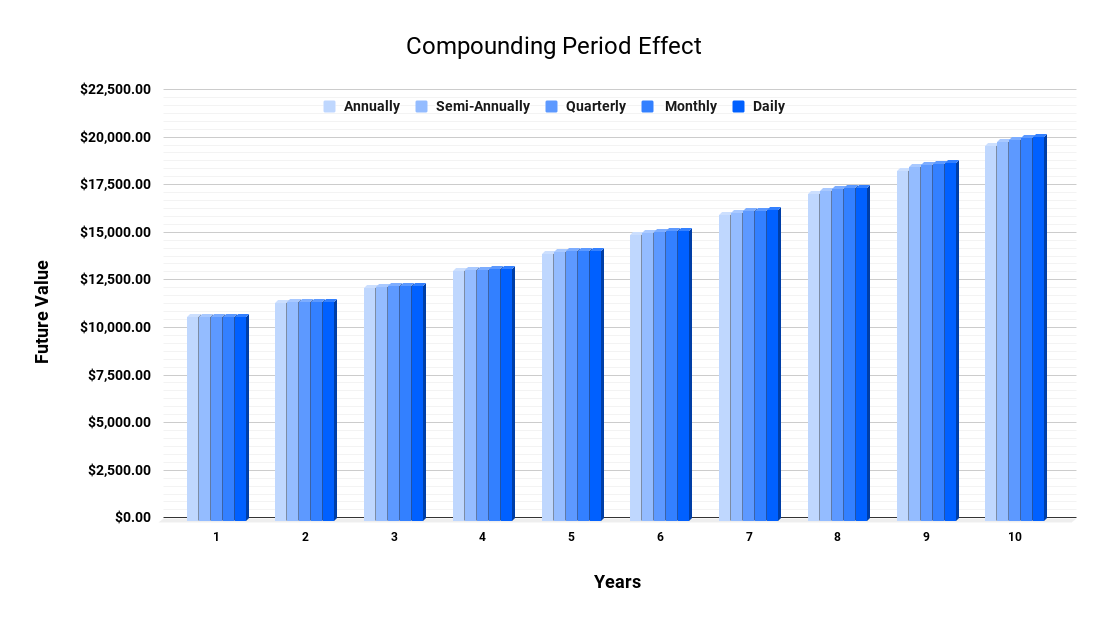

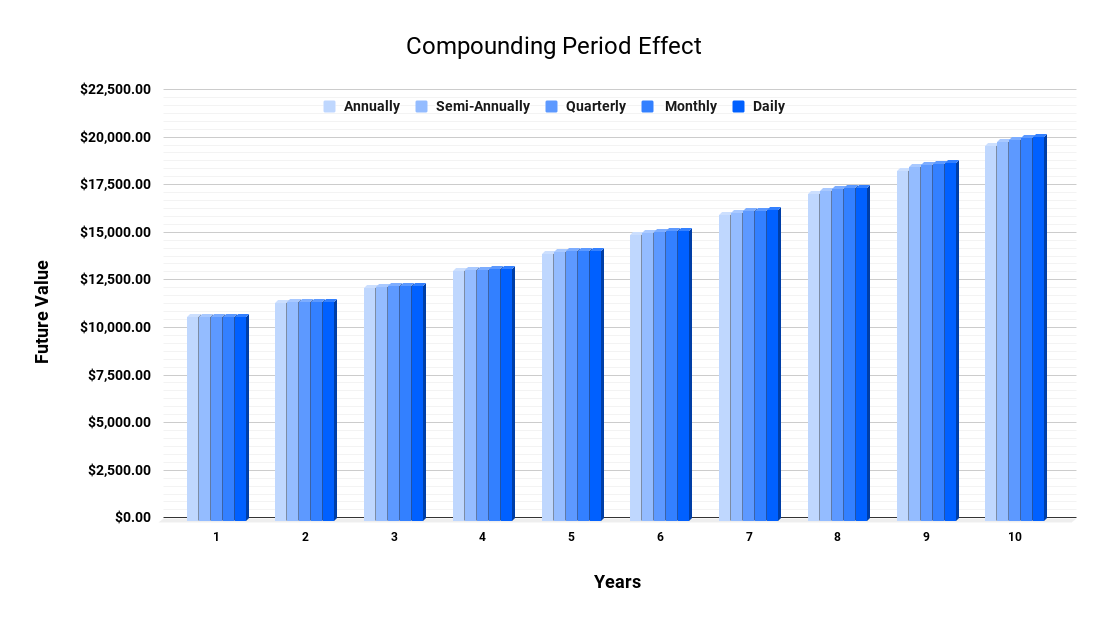

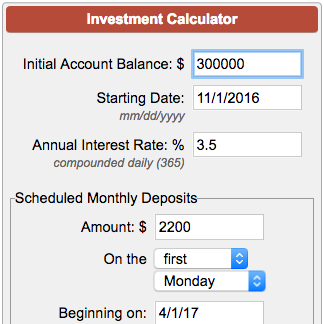

Co-branded card that offers unlimited 4x points on all purchases and no annual fee Get 15000 bonus points after you spend 1000 in your first three months Earn unlimited 7x. User chooses compounding frequency. Most bank savings accounts use a daily average balance to compound interest daily and then add the amount to the accounts balance monthly.

For example if we assume we invested 100 at a 26 rate compounded annually for 1195 days and i use this basic excel formula 1001261001195365 and result is 2131132 and if i do the same calculations in your calculator it shows 21414 please help to explain the difference. This means there is a bit more than 52 weeks in the average year with there being 52 weeks and 1 day in most years while there is 52 weeks and 2. Most bank savings accounts use a daily average balance to compound interest daily and then add the amount to the accounts balance monthly.

The actual rate of return is largely dependent on the types of investments you select. P the principal investment amount the initial deposit or loan amount also known as present value or PV. Most years have 365 days while leap years have 366 days.

Your monthly interest rate Lenders provide you an annual rate so youll need to divide that figure by 12 the number of months in a year to get the monthly rate. Use our compound interest calculator to see how your savings or investments might grow over time using the power of compound interest. Compound interest means the interest from preceeding periods is added to the balance and is included in the next interest calculation.

User enters dates or number of days. This can be. Compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate raised to the number of compound periods minus one.

The formula for compound interest is A P1 rnnt where P is the principal balance r is the interest rate n is the number of times interest is compounded per time period and t is the number of time periods. It uses the compound interest formula giving options for daily weekly monthly quarterly half yearly and yearly compoundingIf you want to know the compound interval for your savings account or investment you should be able to find out by. PV present value initial deposit r annual interest rate as a decimal rather than percent also called APR n number of times interest is.

As a wise man once said Money makes money. Deposit a minimum of 50 up to a maximum of 1000 to the Smart Saver account each month. All withdrawals are fully taxable.

How to calculate your savings growth. Unlike 401ks or IRAs where a penalty typically applies to most 401k withdrawals before age 59 12 there is no such restriction on cash. If your interest rate is 5.

You can choose to make regular monthly quarterly semi-annual or annual withdrawals.

Simple Interest Calculator Audit Interest Paid Or Received

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator

Investment Account Calculator

Compound Interest Calculator For Excel

Compound Interest Calculator With Formula

Compound Interest Calculator For Excel

Compound Interest Calculator And Formula Wise

Compound Interest Calculator And Formula Wise

Retirement Savings Calculator

Savings Withdrawal Calculator How Long Will My Money Last

Capitalize On Uninterrupted Compound Interest Wealth Nation

Compound Interest Calculator

Compound Interest Calculator

Compound Interest Calculator Credit Karma

Compound Interest Calculator Certificates Of Deposit Mathematics For The Liberal Arts Corequisite